After a hurricane, many Florida homeowners face problems with their insurance claims. The most common problem is that insurers often deny claims or lowball the amount they will pay out. This can leave homeowners feeling frustrated and overwhelmed.

Another common problem is that insurance companies may try to cancel policies after a hurricane. This can leave homeowners without the coverage they need to repair or rebuild their homes.

Finally, some insurance companies may refuse to pay for damage caused by flooding. This can be a major problem for homeowners, as flood damage is often not covered by standard homeowner’s insurance policies.

If you’re a Florida homeowner who has been affected by a hurricane, it’s important to know your rights and what you can do to get the compensation you deserve. An experienced hurricane damage lawyer can help you understand your options and fight for the compensation you need to recover from this devastating event.

Insurance Coverage for Hurricane Damage

One of the most common issues Florida homeowners face after a hurricane is insurance coverage for damage. Many homeowners are surprised to find that their policy doesn’t cover as much as they thought it would.

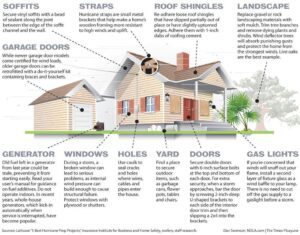

There are a few things to keep in mind when it comes to insurance coverage for hurricane damage. First, wind damage is typically covered by most policies, but flood damage is not. If your home sustains any flooding, you will likely need to purchase a separate flood insurance policy.

Second, even if your policy does cover hurricane damage, there may be limits on how much the insurer will pay out. For example, some policies have a per-item limit for wind damage, which means that if your home sustains multiple instances of wind damage (such as from flying debris), the insurer will only pay out up to a certain amount for each item.

Finally, it’s important to remember that most insurance policies have a deductible that must be met before the insurer will begin paying out any benefits. This means that if your home sustains $10,000 worth of damage from a hurricane, but your deductible is $5,000, you will only receive $5,000 from the insurer (minus any other applicable limits or deductibles).

If you’re unsure about what your policy covers or how much benefit you can expect to receive after a hurricane, it’s best to contact your insurer directly and ask questions. With careful planning and a little bit of luck, you can